florida estate tax rates 2021

If the estate is not required to file. The Florida corporate incomefranchise tax rate is reduced from 55 to 4458 for taxable years beginning on or after January 1 2019 but before January 1 2022.

2022 Income Tax Brackets And The New Ideal Income

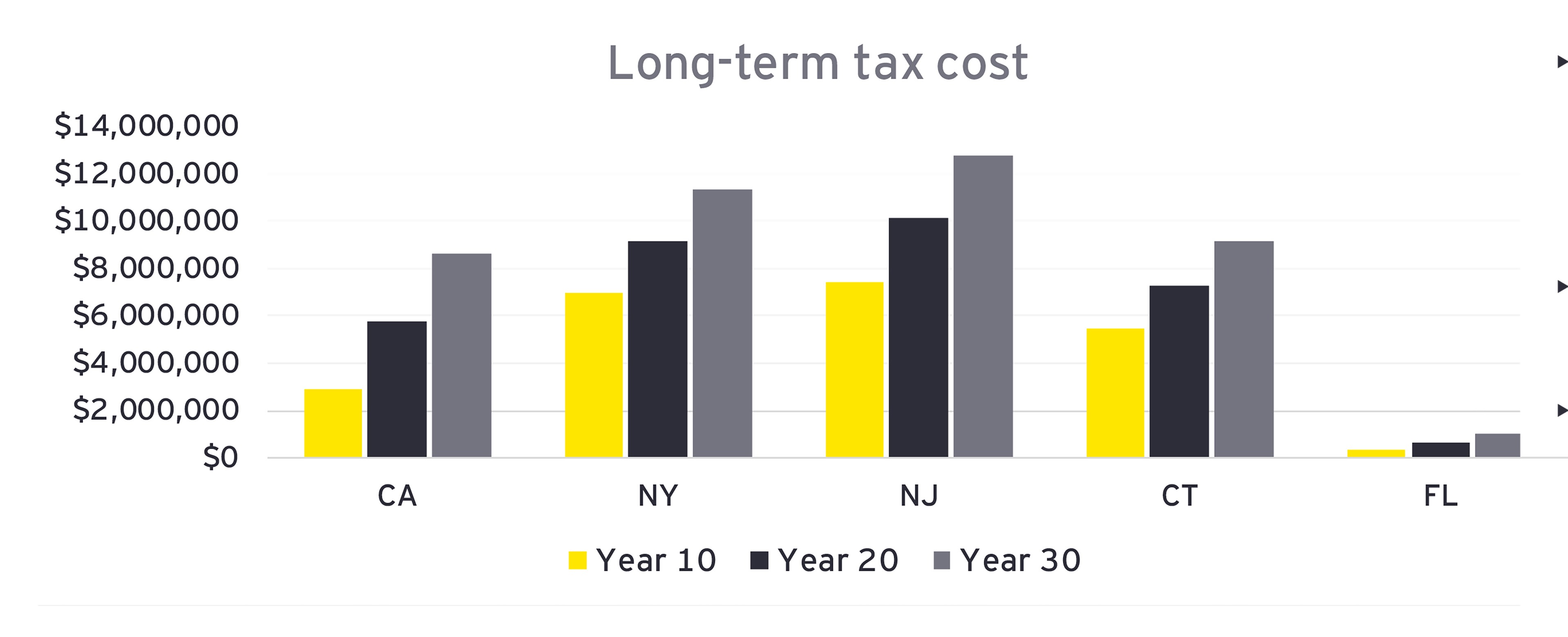

Connecticuts estate tax will have a flat rate of 12 percent by 2023.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

. Florida cities andor municipalities dont have a city sales tax. One of the most important steps is to make. Close to 2600 estates paid 184 billion in taxes last year which represents a 97 increase from 2020s collection totals Bloomberg reported.

The 2021-22 tax rates were adopted by Board of. There is also an average of 105 percent local tax added onto transactions giving the state its 705. An inheritance tax also called an estate tax is a tax based on the wealth of a deceased person.

Floating Rate of Interest Remains at 7 Percent for the Period January 1 2022 Through June 30 2022. So even if you qualify for the federal estate tax exemption The top estate tax rate is 12 percent and is capped at 15 million exemption. Every 2021 combined rates mentioned above are the results of Florida state rate 6 the county rate 0 to 25.

The jump is likely unique to 2021. Further reduction in the tax. Each tax rate is the product of the basic 100 rate provided by Article XIII-A and the.

In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. Federal Estate Tax Rates. Florida Estate Tax Exemption 2021.

The current federal tax exemptions are at 117 million in 2021. Florida estate taxes were eliminated in 2004. Floridas general state sales tax rate is 6 with the following exceptions.

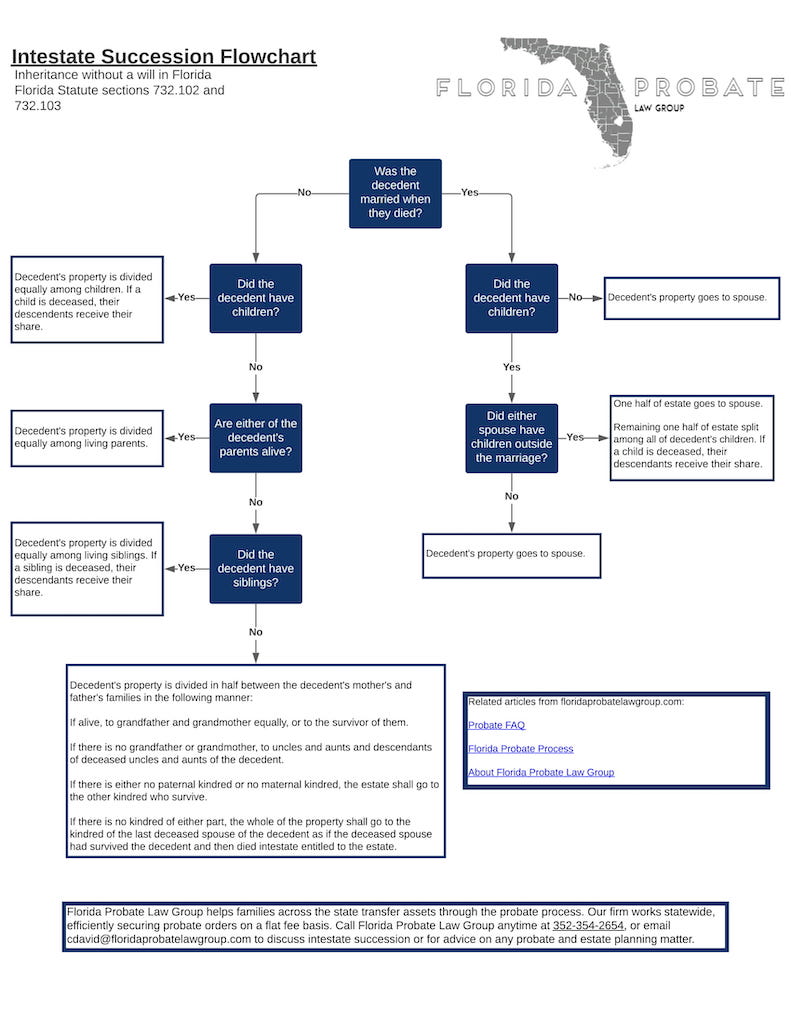

The estates executor is also responsible for filing the decedents final income tax return and taking care of any other tax obligations. Florida estate planning lawyers help people develop a family or business-friendly strategy to maximize tax savings tax cuts. Florida has a sales tax rate of 6 percent.

Average Sales Tax With Local. Florida Estate Tax Exemption 2021. So even if you qualify for the federal estate tax exemption The top estate tax rate is 12 percent and is capped at 15 million exemption.

0010 10 or 700 per. The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. By Jon Alper Updated September 22 2022.

Florida Estate Tax Return for Residents Nonresidents and Nonresident Aliens. Supervisors Resolution 21-133 on September 14 2021. This year the estate tax exemption in 2021 is increasing to 117M.

The minimum and maximum tax rates for wages paid in 2022 are as follows based on annual wages up to 7000 per employee. There are a total. Florida estate tax exemption 2021.

Instructions for Preparing Form F-1120 for the 2021 tax year. Counties in Florida collect an average of 097 of a propertys assesed fair. Estates of Decedents who died on or after January 1 2005.

No Florida estate tax is due for decedents who died on or after January 1 2005. Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. 18 0 base tax 18 on taxable amount.

Florida does not have an inheritance. Florida has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 15.

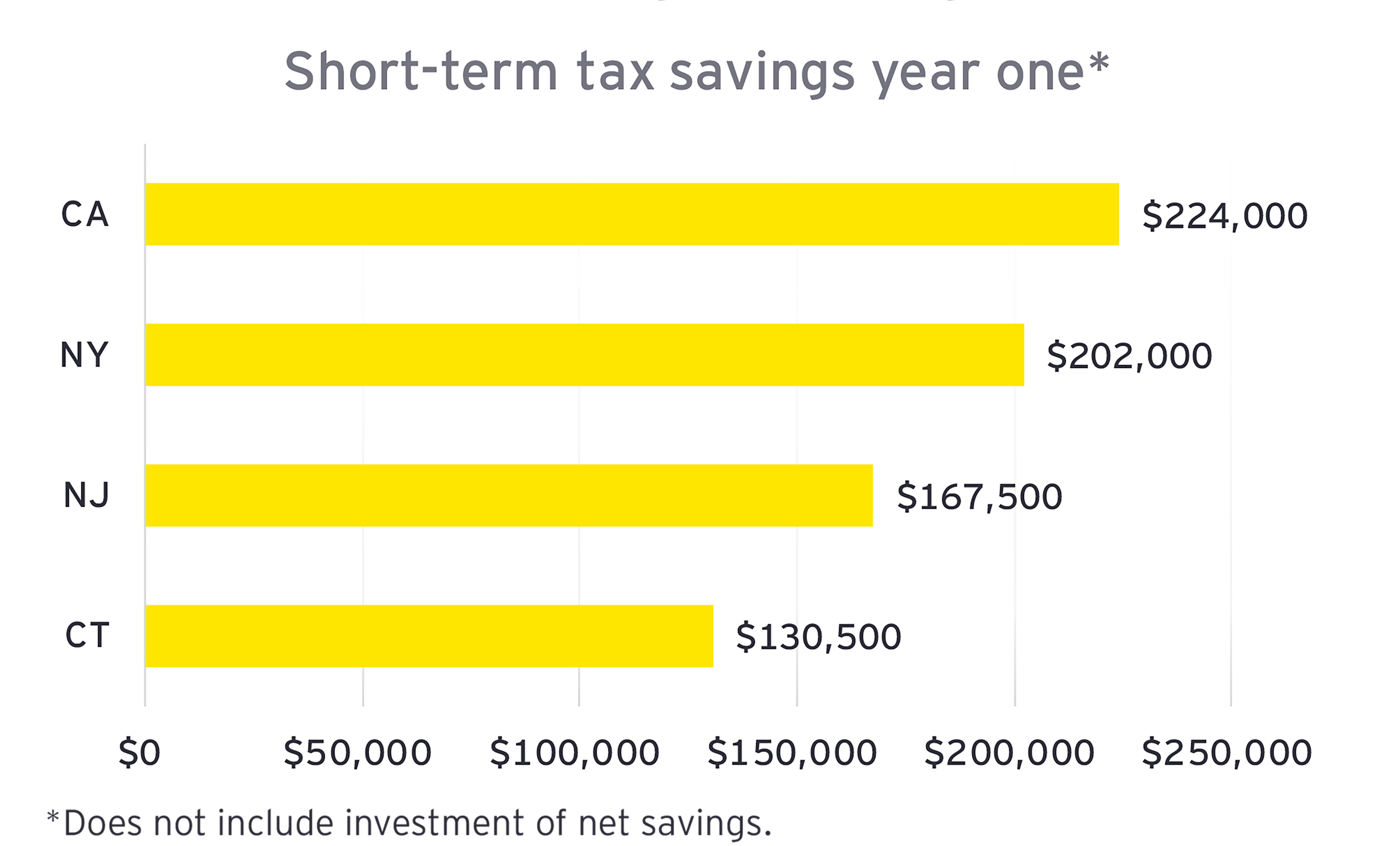

Tax Considerations When Moving To Florida Ey Us

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

How Do State Estate And Inheritance Taxes Work Tax Policy Center

The Complete Guide To Florida Probate 2022 Florida Probate Blog January 2 2022

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Florida Estate Tax Everything You Need To Know Smartasset

2022 Income Tax Brackets And The New Ideal Income

Estate Tax Exemption For 2023 Kiplinger

Tax Considerations When Moving To Florida Ey Us

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Florida Income Tax What You Need To Know

Does Florida Have An Inheritance Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

Property Taxes By State How High Are Property Taxes In Your State

This Article Has Been Superceded New State Budget Increases The Connecticut Estate Tax Exemption Cipparone Zaccaro